The property and casualty insurance industry is looking at increasing underwriting losses in 2022...while workers’ comp (which represents perhaps 1/10 of total P&C premiums) continues to be hugely profitable.

Which begs the question..will multi-line insurers try to use work comp to offset lower profits in other lines?

According to the Insurance Information Institute;

The (P&C) industry’s combined ratio — a measure of underwriting profitability in which a number below 100 represents a profit and one above 100 represents a loss – is forecast to be 105.6, a worsening of 6.1 points from 99.5 in 2021. [emphasis added]

Amidst troubling trends from other P&C lines – personal and commercial auto, property, multi-peril and homeowners, workers comp stands out…this from Milliman’s Jason Kurtz:

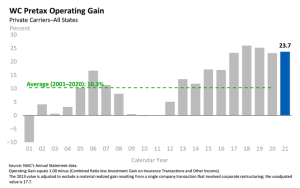

“The workers compensation line continues to stand alone, with its multi-year run of strong underwriting profitability forecast to continue for 2022 and into 2023-2024.”

Premium rates are increasing for pretty much every P&C insurance sector – except workers’ comp – where rates in almost all states are headed in the other direction.

Actuaries at III and Millman project an overall P&C combined ratio of 105.6 for 2022 – while work comp’s looking a combined of 87.2…almost 20 points better (yeah I know those are different years, but not that different).

courtesy NCCI

What does this mean for you?

While multi-line insurers may try to jack up work comp rates to offset losses in other lines, the soft work comp market makes it extremely unlikely that will work…employers will find plenty of carriers very willing to write their business.

Multi line buyers beware. When your profitable WC supports your unprofitable auto and general liability, your management will think everything is fine. When WC turns unprofitable, you’re whole program suffers and your management looks at you and your failing program and won’t be impressed. Better to have each line stand on its own and explain market conditions in each line to your management as things improve or deteriorate.

Hey Steven – much appreciate you weighing in…sounds like sage advice coming from one with experience in this matter…;)

be well Joe