Back from the boys’ annual mountain biking trip…this one to Hurricane Utah. Great riding in a beautiful area…

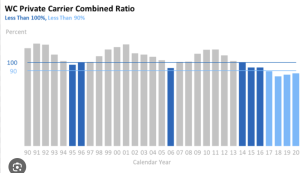

Okay, at last week’s NCCI conference we learned workers’ comp insurance is earning insurers record profits…despite continued drops in claims frequency, rater reductions and pretty much flat medical spend.

Oh, and they’ve got billions more in the form of excess reserves socked away for…reasons that escape me.

For an industry that loves to catastrophize (medical marijuana!!! presumption!!! interest rates!!! COVID!!! WFH!!!) there’s precious little to be concerned about over the near term.

Comp insurance rates and profits are cyclical…have always been and always will be. That does NOT justify the too-high premiums employers and taxpayers are paying today…but smart industry execs should be using this flood of cash to prepare for the inevitable downturn.

That will happen when:

- the opioid hangover ends,

- facility costs climb,

- and unprepared payers start calling for rate increases, increases that would be necessary only because payers failed to prepare.

This is absolutely going to happen.

Very few payers are using this time and their billions to invest, innovate, build systems, train their people and build a resilient culture.

Why take “risks” or actually work smart and hard when the balance sheet is glorious?

Nope, payers are (mostly) lazing through these halcyon days taking meetings, playing golf with erstwhile vendors, celebrating their good fortune, and leaving the future to…the future.

Here’s a few things payers should be doing…

- building much better approaches to facility costs

- asking their vendors what they can do better

- building useful tech that makes front-line staff’s work easier, simpler, and most of all more rewarding

- building a culture based on valuing (really valuing) workers

- innovating and taking risks by trying new technology and new approaches

What does this mean for you?

If one steps back, looking at trends over decades, we see a “big fade” in the role of workers comp in the economy and society. Used to be the work injury risk was a very serious phenomenon, reflected in the use of worker deaths as a polto device in fiction. This is still present in some areas, for instance moderate / severe head injuries are 10% work related. But in the past 30 years, the distinctiveness of work injuries from general health injuires has faded and the risk of injury has gone down, by about 3% a year since the 1980s. So why have such an elaborate regulatory structure — with its state capture features — for a risk which is really, except for perhaps 50,000 – 100,000 injuries a year, part of the mainstream in health matters? A big failure of the opt-out system is that it did not focus on integrating WC with ST and LT disability and healthcare insurance

Thanks for the trenchant observation Peter.

Having been involved in the “24 hour” thing a couple decades + ago, I don’t see occ health being added to any health plan any time. There’s too much entrenched resistance.

Of course it should be…just as group health / Medicare / Medicaid should care about functionality.

be well Joe