Great news on the economy…

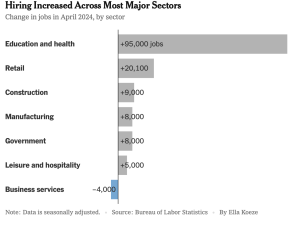

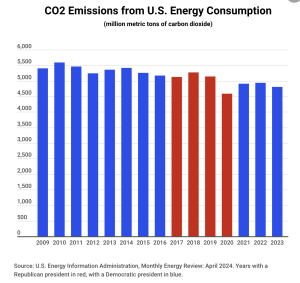

The labor market stays strong, inflation is slowing, and the stock market continues to boom.

- Dow hit 40,000 this week and the S&P hit an all-time high

- Other stock indices have seen even higher gains than the Dow.

- Inflation “cooled” in April driven by price increases of <3% for food and energy

One economist noted “the April report put a soft landing and 2024 rate cut back in investors’ sights…”

That’s about as good as it gets…but just the latest in a long string of economic improvements over the last three years.

About that 401(k)…

Folks with 401(k)s are enjoying a big jump in account value – Bank of America reported the average account increased 17%

Protecting consumers

This week the Supreme Court rejected the payday loan industry’s latest legal attempt to block consumer protections. The Consumer Financial Protection Board was created after the 2008 financial crisis to regulate predatory lending, mortgages, car loans and other consumer finance.

With this ruling, expect the CFPB to push for rapid adoption of consumer protections including:

- an $8 limit on most credit card late fees,

- enforcing limits on interest rates lenders can charge active-duty military members

- actions to enforce judgements against predatory practices by for-profit schools

- much tighter controls over payday lenders

- requirements for banks to share data on small business loans to monitor for discrimination,

Ukraine…

Lastly, our allies in Ukraine are FINALLY getting the support they desperately need…and using it to great effect. Earlier this week several jets and buildings at a key Russian Air Base in Crimea were destroyed.

photo credit CNN

More on what’s happening there next week.

What does this mean for you?

- fatter retirement accounts,

- lower inflation,

- and a smackdown of predatory lenders.