There’s a LOT of good news today…

The House finally approved a massive aid bill for Ukraine – and the aid is already flowing – hallelujah.

Several encouraging takeaways…

- It was bipartisan, with strong support from both parties (who’da thought??)

- It passed despite strong opposition from the Republican Presidential candidate

- It includes long-range missiles that Ukraine can use to demolish Russian air defenses, oil infrastructure, shipping, bridges and railroads

Long range ATACMS

Here’s why this is so incredibly important…

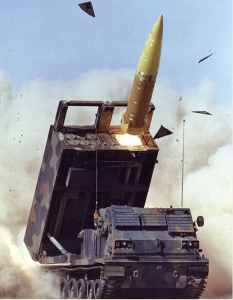

Health insurance coverage

is benefiting more Americans than ever, thanks to expansion of the Affordable Care Act. Another major driver is the increase in insurance subsidies for lower-income folks.

This means more moms and dads, kids, and families have access to health care.

The addition of dental care is the cherry on top; new regs allow states to add that coverage.

Work comp

WCRI’s just released in-depth analyses in its CompScope series…this year they’ve added details on COVID’s impact in 17 states.

Work comp rates for employers continue to drop – IVANS reported a drop of 0.9% for the first quarter of this year. (Hat tip to R&I for the news)

California is slamming work comp fraudsters, (sub req) with the latest conviction resulting in a 54+ year prison sentence for a scheming fraudster. The Golden State’s been ramping up its prosecution of these dirtbags...here’s hoping these massive penalties discourage others from stealing from employers and taxpayers. Kudos to WorkCompCentral for a comprehensive update on recent convictions.

What does this mean for you?

A safer America comes from a diminished Russia.

More insured Americans = healthier families.

More crooks in jail = hopefully less future fraud.