We are stuck in a self-destructive cycle, namely an industry-wide culture that rejects true innovation that leads to a huge talent deficit that prevents innovation.

With few exceptions, there is little in the way of innovation, effective marketing, risk-taking, creativity and substantive investment in systems and technology in the insurance industry. That will be the death of many insurers and healthplans.

As a result, we can’t get enough brilliant, impactful people to work in our business because our culture is anathema to most of them.

So, there’s no innovation.

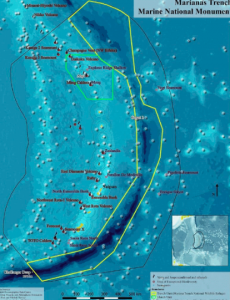

The most important part of any organization is its people. Yet our industry’s talent deficit is as wide and deep as the Marianas Trench. Sure, there are some very smart folks doing great work – in healthplans, State Funds, private insurers, TPAs, and service companies.

They are the exception, not the rule.

Don’t agree?

How many of your brilliant college classmates chose a career in insurance? In your career, you were blown away by someone’s acumen, insight, brilliance, thinking how many times? How many execs in this business came out of top business or other schools?

Why is this?

I’d suggest it is the very nature of our industry; it isn’t dynamic, doesn’t reward innovation, hates self-reflection, abhors risk-taking, and doesn’t invest near enough in people or technology.

Proof statements, courtesy of The Economist

- No insurer ranks among the world’s top 1,000 public companies for R&D investment – yet dozens of insurers are in that top 1000.

- On average insurers allocate 3.6% of revenue to IT —about half as much as banks.

- In a study of 500 innovation topics across 250 firms, many insurers are working on the same narrow set of ideas.

- Many property insurers, whose fortunes rely on forecasting climate-induced losses, are still learning how to use weather information.

Tough to recruit talent to an industry that – for Pete’s sake, invests half what banks do in IT…

- Or for a property insurer that hasn’t figured out weather is kinda important?

- Where all your competitors define “innovation” as doing the same stuff you do?

- That probably spends more on janitorial services than R&D? (Ok, that may be a bit of an exaggeration.)

Many of the big primary insurers in today’s market will be overtaken by the Apples, Amazons, Googles, Beazleys, Trupos, and Slices tomorrow. The names you know are brilliant innovators and have billions upon billions of cash to invest. The names you don’t know have figured out and are diving into markets that the traditional, stodgy, glacially-fast insurers can’t even conceive of – reputational risk, very short-term insurance for specific items, disability coverage for gig workers, and a host of other opportunities.

Oh, and they are doing it without all the paperwork, hassle and nonsense that keeps insurance admin expenses at 20% of premiums while frustrating the bejezus out of potential customers. (having just spent hours on the phone fixing a problem with flood insurance, count me as one)

And no, with rare exceptions health insurers aren’t any better. With structural inflation that guarantees annual growth of 5-8% and an employer customer that has to provide workers with health insurance, plus governmental contracts that pay on a percentage of paid medical, and record profits across the entire industry, there’s every reason to NOT control costs.

Those record profits may well continue till a Cat 5 storm hits the Jersey shore and/or a deep recession hits and/or investment portfolios are crunched by macro factors.

In the meantime, Jeff Bezos will be looking for places to plow some of his hundreds of billions.

Tomorrow – what to do about this.

What does this mean for you?

Critical self-reflection is really hard, and really necessary. This industry is ripe for disruption and it will happen. The question is, what will you – and your company – do?

Amen! Great article.

I am an optimist with respect to the potential that we will soon see an infusion of talent into the insurance industry unlike anything that we have seen for decades. What may be a surprise for many is that this talent will arrive in the form of people who are leading and/or working for companies who are NEW to our industry. New people, ideas and innovations will arrive from the outside-in rather than from the inside-out.

Joe – I completely agree with you. Part of the reason we don’t truly innovate is the nature of the business itself. We were trained to need stability and predictability to price our product. When there is change, we get really, really nervous. As with almost any established industry it will take an outsider(s) to make significant change – look at auto manufacturing for example. Henry Ford more or less perfected the assembly line. It wasn’t really until the Japanese threatened the big 3 in the 70’s that manufacturing changed. Now Musk looks like he might actually make some real sales numbers, potentially changing the business again. I wasn’t around, but remember when the current HO policy was revolutionary because it combined coverages??

Joe, great article and call out. Let me just add that once we get the technology, we also need to share/compare data and successes/failures if we are to move forward. I’ve been around too long to be naive about why data, such as it s, is looked at as a competitive edge but, really, can we look at some solutions? Regardless of the type of insurance (except maybe your flood insurance through FEMA), we know what is needed, we have the ability to capture and use data, and we just keep on circling the same drain in the same ways.

Hey Deb – thanks for the note and input. Insurance – where innovation doesn’t go to die, it’s where innovation is never born.

This article is right on. I have been talking to my high school aged son about a potential career in insurance/adjusting as there will be a great need for new talent in the very near future. There is a definite lack of innovation or thought on how to attract new talent. Our close-to-retirement-age colleagues who are leading the charge have a tendency to be territorial, to do things as they’ve always been done, not want to rock the boat, and are essentially hunkered down doing what they can/what they know until retirement. That results in stagnation and demotivation, and definitely doesn’t attract young people into this complex and challenging industry. What’s that old saying? If everyone is comfortable, we’re not making progress? We definitely need an infusion of energy and new ideas, but in some corporate cultures, that will be hard to come by without some of the leadership aging out and retiring.